(The author is a financial planning coach, founder and CEO of Money Avenues, a Wealth Management firm based in Chennai. Mail him at: finplancoach@gmail.com)

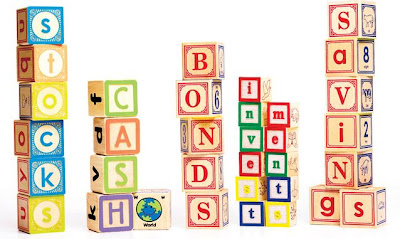

Same is the case with our financial planning. Achieve bigger things in life block by block through EMIs.

Easy Monthly Investments (EMIs)

EMIs (Easy Monthly Investments) are key to achieving our financial goals through the financial planning. And they help you create long term assets.

Easy monthly investments can help you achieve your following financial goals:

1. Inflation Shield:

Inflation is a monster which is capable of derailing the best of all future plans, if not handled the right way. To begin with, It's not prudent to keep much of your money in a bank savings which earns 3.5% pa.. And compare that with inflation which is around 10-11%. Instead do an EMI into products like equity which can effectively beat the inflation hands down and generate good returns over the longer periods. Inflation hedge will have to be a key financial goal for the future and suitable investment strategy should be built around that goal.

For eg.,

If you keep 1 lac in a bank savings a/c, after a year it would have given Rs 1,03,500 @ 3.5%.

On the other hand, had you parked the same 1 lac in an avenue which earned 15%, it would have given Rs 1,15,000. This difference is only for one year. But this equation can cause havoc over the longer term due to the effect of compounding. Keeping money in the bank is definitely not the right option to fight the inflation monster.

Have a set amount every month through an EMI for your regular saving into an appropriate avenue. Remember, saving alone is not important.

Inflation hedge is just a part of the overall investment strategy, the larger aim should be to create long term wealth creation. The Easy Monthly Investing (EMIs) is the best possible way to create long term wealth and to meet the "expect the unexpected" situations.

3. Personal life cover:

In simple words, life insurance is nothing but a financial cover for one's family in his absence. Simply put, Mr X is covered for his life for 50 lacs @ the age of 40. At 45, mishap strikes to take away Mr X. On this event his family gets Rs 50 lacs as financial compensation. It is an important component of a financial plan because, any mishap at a later stage should not in any way impact the family's financial future. So in a way this is a contingency fund for a family.

As one grows in career and income levels, its ideal that the person should always maintain the insurance cover at the prevailing income levels. For eg., X's salary is 10 Las PA and he has a cover of 50 lacs. If his salary moves up to 15 lacs after few years, his insurance should also increase correspondingly, in this case it should go up to 75 lacs.

Thumb rule for taking an insurance cover is "earlier the better" which means the cost of cover goes up with one's age. Two people aged 30 and 40 will have substantially different premiums for the same amount of cover.

And opting for life insurance through EMI is always the easiest option in a financial plan.

4. Children future plans:

5. Pretirement planning:

Typical every one wants to pretire from job, but not from income. The ideal way to create our pretirement fund is take the EMI route and create wealth for our pretirement goals.

Speak to experts @ Money Avenues for the best financial planning solutions and build your financial goals block by block.

(The author is a financial planning coach, founder and CEO of Money Avenues, a Wealth Management firm based in Chennai. Mail him at: finplancoach@gmail.com)

No comments:

Post a Comment